This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 2,144.30 +3.12%

Bitcoin (BTC): $71,248.64 +3.76%

Ether (ETH): $2,625.97 +3.89%

S&P 500: 5,823.52 +0.27%

Gold: $2,747.55 +0.17%

Nikkei 225: 38,903.68 +0.77%

Top Stories

Bitcoin rose to over $71,200 early European morning on Tuesday amid a significant uptick in trading activity. BTC broke through the $70,000 barrier for the first time since June on Monday, prompting $48 billion in trading volume and over $143 million in shorts being liquidated across the crypto market. Bitcoin is around 4% higher in the last 24 hours, while the broader digital asset market, as measured by the CoinDesk 20 Index, is up by over 3.2%. DOGE led the gains, jumping over 14% to around $0.165, while ETH rose above $2,600 on the back of a 3.9% rise.

DOGE futures interest is nearing record levels, thanks to increasing confidence of Donald Trump winning next week’s presidential election. Traders view DOGE as an election play thanks to Elon Musk’s endorsement of the Republican candidate, and by extension the possibility of Musk running a “Department of Government Efficiency,” abbreviated as D.O.G.E. DOGE-denominated futures have risen 33% since Sunday to 8 billion tokens as of European morning hours Tuesday. “Elon is memeing the idea of a ‘Department of Government Efficiency’ into reality and is able to tie it to DOGE somehow,” influential X account @theunipcs told CoinDesk. A Trump victory next week would bring “an even more parabolic move in dogecoin,” @theunipcs added.

Trading on Crypto.com has exploded this year, pushing the crypto exchange’s volumes in North America ahead of Coinbase. Crypto.com’s monthly spot trading volume soared to $134 billion in September from $34 billion in July, according to data from The Block. Overall trading volumes on North American crypto exchanges was $183 billion in September, in which Coinbase handled $46 billion. Kraken, the third-largest exchange, was way behind in October with just under $10 billion in trading activity. A key reason for its popularity could be the wide range of tokens on offer. Crypto.com lists over 378, compared to Coinbase and Kraken which offer fewer than 290 tokens each.

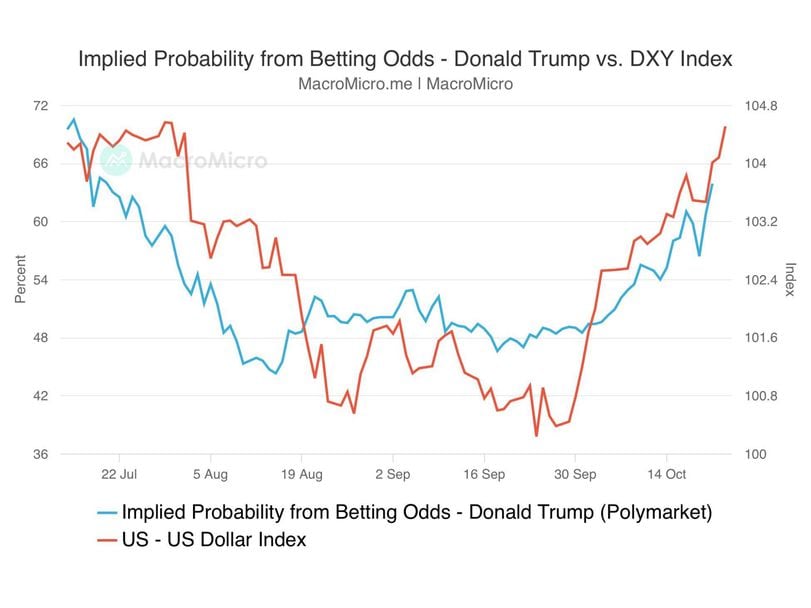

Chart of the Day

– Jamie Crawley